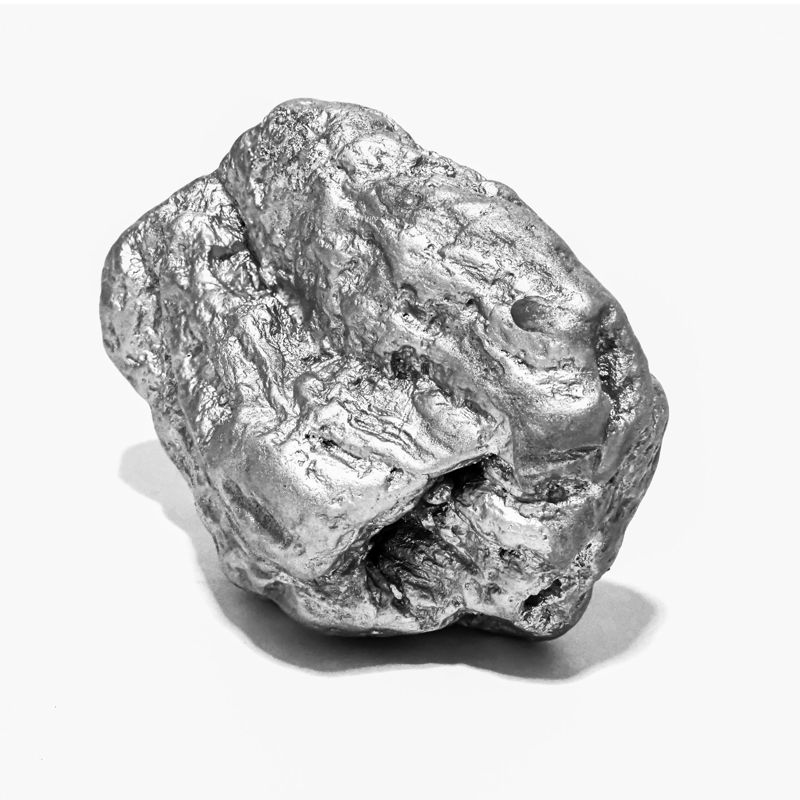

The world consumes more silver than is mined. Silver is so undervalued that its price could rise five hundredfold after the next collapse of the paper money system.

Silver has been mined since about 5 000 BC. The first documented silver mines were near Athens. Today, most silver comes from Peru, Mexico and China. However, the largest silver mine operators are in Canada.

Mining has become more efficient over the centuries, especially in the late 19th century. However, as coins lost their importance and the silver standard slowly gave way to gold, the price of the precious metal fell dramatically.